PR Form 499 R-4.1 2016-2025 free printable template

Show details

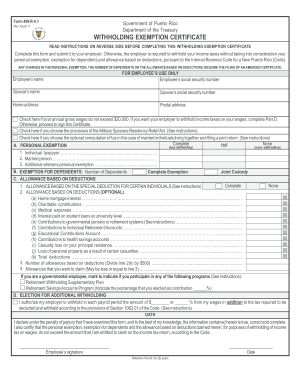

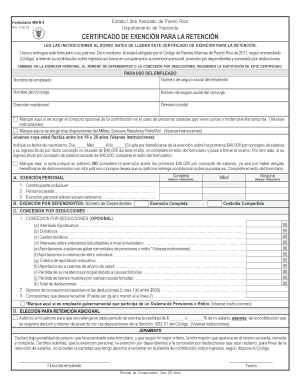

Form 499 R-4. 1 Commonwealth of Puerto Rico Department of the Treasury Rev. Dec 13 16 WITHHOLDING EXEMPTION CERTIFICATE READ INSTRUCTIONS ON REVERSE SIDE BEFORE COMPLETING THIS WITHHOLDING EXEMPTION CERTIFICATE. Complete this form and submit it to your employer. Otherwise the employer is required to withhold your income taxes without taking into consideration your personal exemption exemption for dependents and allowance based on deductions pursuant the Puerto Rico Internal Revenue Code of...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign form 499r 4 1

Edit your 499 r4 1 pdf form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 499 r 4 1 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 499 r 4 online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit pr 499 r41 form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PR Form 499 R-4.1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form 499r41

How to fill out PR Form 499 R-4.1

01

Gather necessary personal and financial information such as name, address, and taxpayer identification number.

02

Obtain a copy of PR Form 499 R-4.1 from the relevant government website or office.

03

Fill in the identification section with accurate and complete information.

04

Provide details of income sources and any applicable deductions or credits.

05

Review the instructions provided on the form for any specific requirements related to your situation.

06

Double-check all entries for accuracy to avoid delays or issues.

07

Sign and date the form in the designated area.

08

Submit the completed form through the appropriate channel as stated in the instructions.

Who needs PR Form 499 R-4.1?

01

Individuals or entities required to report income for tax purposes in Puerto Rico.

02

Those applying for certain deductions or credits relevant to their tax situation.

03

Taxpayers who meet specific eligibility criteria set by the Puerto Rican tax authorities.

Fill

puerto rico withholding certificate

: Try Risk Free

People Also Ask about pr 499 r41 printable

What is 499 r2?

What is 499 r2? It identifies the employer whose employee wage and tax information is being reported.

How do I register my payroll in Puerto Rico?

Registering for Puerto Rico Payroll Tax Account Numbers Register online. To find an existing account number, call: (787) 754-5353.

What is the New York State tax withholding form?

To claim exemption from income tax withholding, you must file Form IT-2104-E, Certificate of Exemption from Withholding, with your employer. You must file a new certificate each year that you qualify for exemption.

What is the withholding on services in Puerto Rico?

The 7% withholding tax applies to all professionals involved in a trade or business or which generate income in Puerto Rico for services rendered in Puerto Rico. The withholding applies to payments made to a health provider for health services rendered.

Should I claim 1 or 0?

Claiming 1 reduces the amount of taxes that are withheld from weekly paychecks, so you get more money now with a smaller refund. Claiming 0 allowances may be a better option if you'd rather receive a larger lump sum of money in the form of your tax refund.

What form do I use for income tax withholding in Puerto Rico?

The Withholding Exemption Certificate (Form 499 R-4.1) is the document used by the employee to notify his/her employer of the personal exemption, exemption for dependents and the allowance based on deductions. These three factors are considered to determine the income tax to be withheld from the employee's wages.

How do I fill out a withholding form?

How to fill out a W-4 in 2023 Step 1: Personal information. Enter your name, address, Social Security number and tax-filing status. Step 2: Account for multiple jobs. Step 3: Claim dependents, including children. Step 4: Refine your withholdings. Step 5: Sign and date your W-4.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in pr withholding exemption template?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your pr 499r4 1 printable to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

Can I sign the form 499 r 4 1 electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your withholding puerto.

How do I edit 499r on an Android device?

You can make any changes to PDF files, like forma 499 r 4, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is PR Form 499 R-4.1?

PR Form 499 R-4.1 is a government form used for reporting certain financial and tax-related information in Puerto Rico.

Who is required to file PR Form 499 R-4.1?

Individuals and entities in Puerto Rico that meet specific income thresholds or criteria set by the government are required to file PR Form 499 R-4.1.

How to fill out PR Form 499 R-4.1?

To fill out PR Form 499 R-4.1, individuals or entities need to provide their financial information, income details, deductions, and any other required tax-related data as stipulated by the instructions on the form.

What is the purpose of PR Form 499 R-4.1?

The purpose of PR Form 499 R-4.1 is to ensure accurate reporting of income and compliance with tax obligations in Puerto Rico, which facilitates proper tax assessment by the authorities.

What information must be reported on PR Form 499 R-4.1?

The information that must be reported on PR Form 499 R-4.1 includes details about the taxpayer, total income, exemptions, deductions, and any applicable tax credits.

Fill out your PR Form 499 R-41 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 499 is not the form you're looking for?Search for another form here.

Keywords relevant to formulario 499 r 4 rev 30 jun 11

Related to 499 4

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.